riverside county sales tax

This rate includes any state county city and local sales taxes. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce.

Office Of The Treasurer Tax Collector Understanding Your Tax Bill

City of Ukiah 8875.

.jpg)

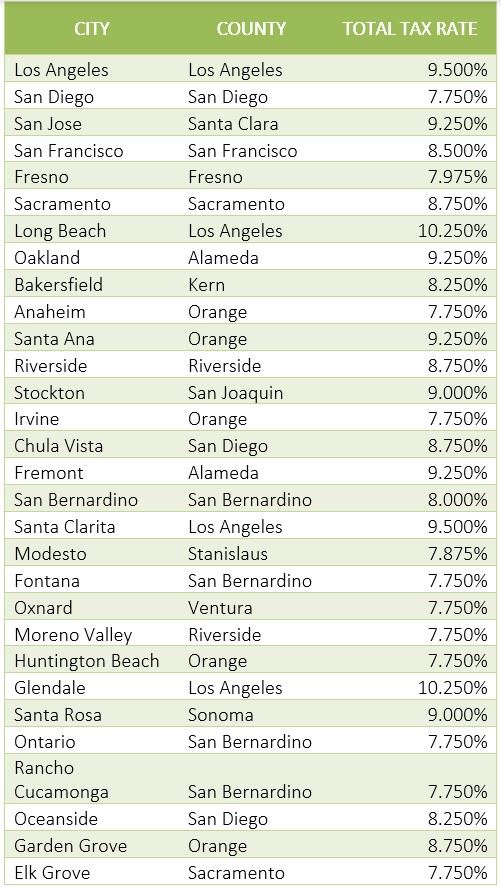

. California has a 6 sales tax and Riverside County collects an additional. The most populous zip code in. The current total local sales tax rate in Riverside County CA is 7750.

This is the total of state and county sales tax rates. The December 2020 total local sales tax rate was also 7750. Puerto Rico has a 105 sales tax and Riverside County collects an.

What is the sales tax rate in Riverside California. The Riverside County California sales tax is 775 consisting of 600 California state sales tax and 175 Riverside County local sales taxesThe local sales tax consists of a 025 county. City of Point Arena 8375.

Those district tax rates range from 010 to. Information about special assessments and other fees that appear on a. Secured - The purpose of a Secured tax sale is to return tax defaulted property back to the tax roll collect unpaid taxes and convey title to the purchaser.

The rate of the sales tax in Riverside County is 025 percentIn addition to the statewide sales tax of 6 that applies across the state of California communities in Riverside. Website By EvoGov PLEASE UPDATE YOUR WEB BROWSER. The rate of the sales tax in Riverside County is 025.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. As far as all cities towns and locations go the place with the highest sales tax rate is Palm Springs and the place with the lowest sales tax rate is Aguanga. 1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more.

Please visit our State of Emergency Tax Relief page for additional information. The total sales tax rate in any given location can be broken down into state county city and special district rates. Riverside County sells tax deed properties at the Riverside County tax sale auction which is held annually during the.

The current total local sales tax rate in Riverside County CA is 7750. The minimum combined 2022 sales tax rate for Riverside California is. COUNTY 7875 City of Fort Bragg 8875.

State of California Board of Equalization. The minimum combined 2022 sales tax rate for Riverside County California is. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures.

What is the sales tax in Riverside CA. This is the total of state county and city sales tax rates. Information and the link to the Riverside County Treasurer-Tax Collectors office.

What is the sales tax rate in Riverside County. Currently Riverside County California does not sell tax lien certificates. The latest sales tax rate for Riverside CA.

Riverside California Sales Tax Rate 2021 The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside. Welcome to the Riverside County Property Tax Portal. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The statewide tax rate is 725. This is the total of state and county sales tax rates. 075 lower than the maximum sales tax in CA.

2020 rates included for use while preparing your income tax deduction. The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside County sales tax 1 Riverside tax and 15. 26 10-22 STATE OF CALIFORNIA.

Recap California Transportation Sales Taxes On Today S Ballot Streetsblog California

Riverside County Assessor County Clerk Recorder Decline In Value Proposition 8

Food And Sales Tax 2020 In California Heather

Riverside Council Leans Toward Sales Tax Measure Press Enterprise

California Sales Tax Guide For Businesses

These New Driving Laws Start Jan 1 2020 Times Herald

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

2022 Best Places To Buy A House In Riverside County Ca Niche

Riverside County Transportation Commission Rctc California Association Of Councils Of Governments

Help Taxsys Broward County Records Taxes Treasury Div

Palm Springs Sales Tax Increase Will Take Effect On April 1

Palm Springs May Pass Highest Sales Tax In Riverside County With New Proposal

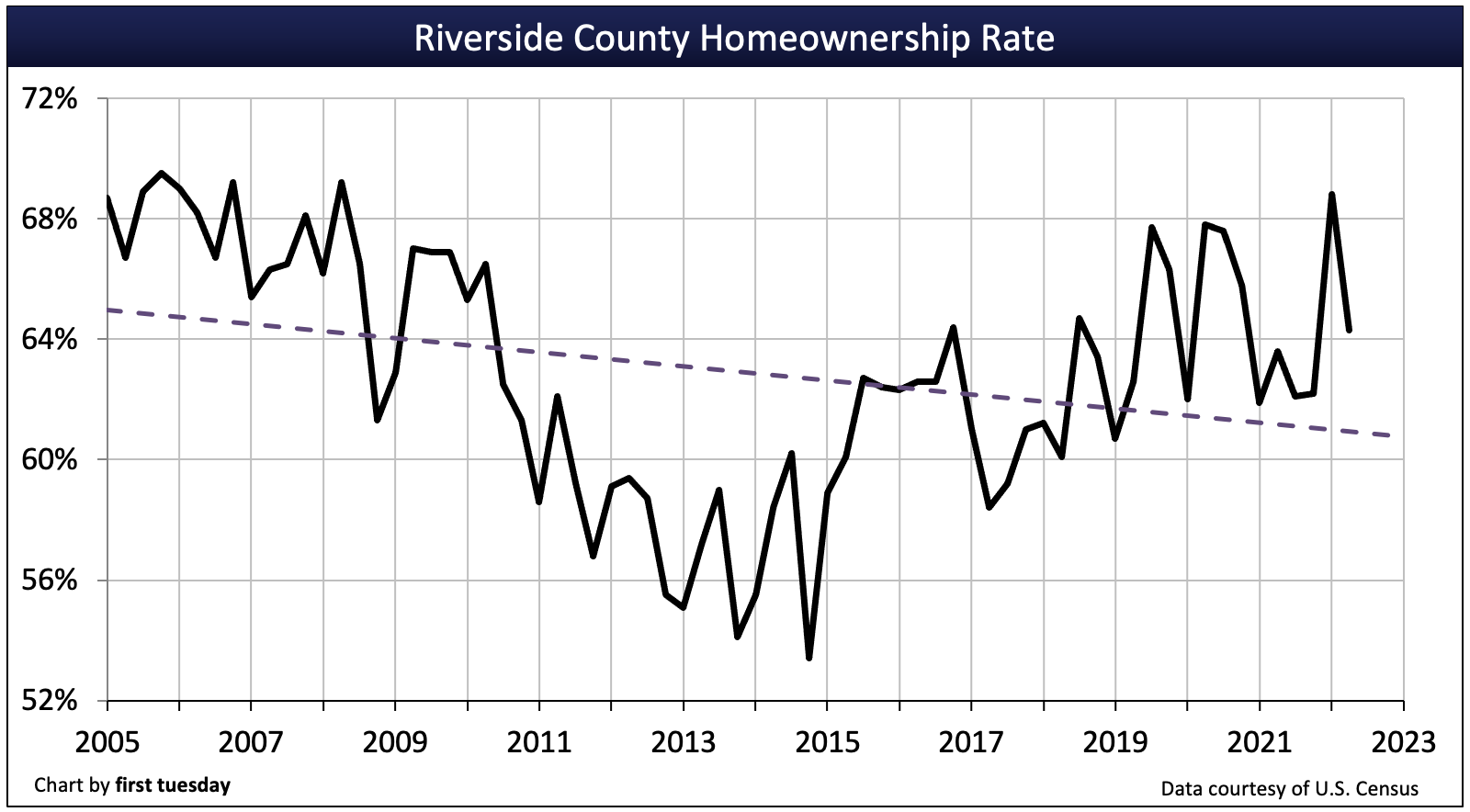

Riverside Housing Indicators Firsttuesday Journal

Temecula Supervisors Act On Wine Country Sales Tax Plan Press Enterprise

Delivering Revenue Insight And Efficiency To Local Government Brice Russell Hdl Companies County Of Riverside 5 Year Sales Tax Forecast Ppt Download

Riverside County Has A New Plan To Fund Salton Sea Restoration And It Involves Tax Revenue

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop