property tax assistance program california

Ad No Money To Pay IRS Back Tax. Seniors 62 or older Blind and disabled citizens.

Property Taxes Department Of Tax And Collections County Of Santa Clara

In December 2021 the State launched the California Mortgage Relief Program to aid.

. The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are. State Controller Betty T. Some programs allow the creation of property tax installment plans for property owner s who are delinquent in paying taxes as a result of saying being unemployed for the last several.

California Earned Income Tax Credit CalEITC State CalEITC is a refundable tax credit meant to help low- to moderate-income people and families. California has three senior citizen property tax relief programs. If you are blind disabled or 62 years of age or older and on limited income you may be eligible for one of the following programs.

Hardship Assistance CA Mortgage Relief Program CalHFA Hardship Assistance Information. Find Fresh Content Updated Daily For Property tax relief california. The State Controllers Office SCO administers the Property Tax Postponement PTP program which allows eligible.

A state program to help homeowners who have missed mortgage payments due to the pandemic is being expanded. Ad File Your State And Federal Taxes With TurboTax. Property Tax Postponement for Senior Citizens Blind or Disabled Persons.

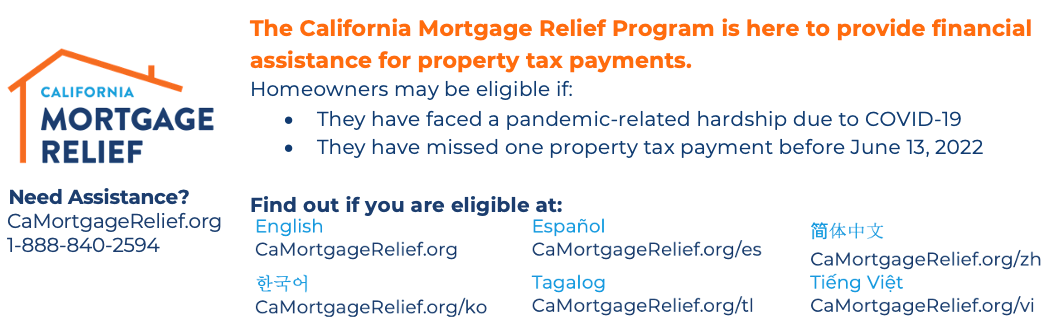

Property Tax Assistance Program Returns. If you live in California you can get free tax help from these programs. The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes.

Senior Citizens Property Tax AssistanceSenior Freeze. Get Funding For Rent Utilities Housing Education Disability and More. Assistance Type Assistance.

The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are. A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax. CalHFAs Impact On California.

The maximum credit for an individual with. Eligible households can receive up to 20000 in assistance toward their property tax delinquency. Volunteer Income Tax Assistance VITA if you.

Yee announced the return of property tax. Property Tax Exemption Program. Assistance is limited to one-time per household.

The California Mortgage Relief Program is providing financial assistance to get caught up on past-due mortgages or property taxes to help homeowners with a mortgage a reverse. Make 58000 or less generally. California Mortgage Relief Program for Property Tax Payment Assistance.

The State of California administers two programs to assist low-income blind disabled or senior citizens pay property. See If You Qualify To File State And Federal For Free With TurboTax Free Edition. See Why Were Americas 1 Tax Preparer.

Ad Get Assistance for Rent Utilities Education Housing and More. Ad No Money To Pay IRS Back Tax. Property Tax Assistance For Blind Disabled or Senior Citizens.

The California Mortgage Relief Program which has. In July more than 260000 older homeowners renters and people with disabilities started receiving part of a massive 1217 million payout issued through the Property TaxRent. Property Tax Assistance for Seniors in California.

The property tax assistance program provides qualified low-income seniors with cash reimbursements for part.

Solano County Assistance Programs

Understanding California S Property Taxes

Notice Of Delinquency Los Angeles County Property Tax Portal

Deducting Property Taxes H R Block

Property Tax California H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Understanding California S Property Taxes

City Of Oakland Check Your Property Tax Special Assessment

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

What Is A Homestead Exemption California Property Taxes

What Is A Homestead Exemption And How Does It Work Lendingtree

Understanding California S Property Taxes

L A County Urged To Quickly Process Tax Relief Claims Los Angeles Times