peoria az sales tax calculator

The sales tax jurisdiction name is Peoria Maricopa Co which may refer to a local government division. The Peoria Sales Tax is collected by the merchant on all qualifying sales made within Peoria.

Bonds Overrides Property Tax Calculator

The December 2020 total local sales tax rate was also 8100.

. Gila County 66 percent. The current total local sales tax rate in Peoria OK is 6850. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The average cumulative sales tax rate in Phoenix Arizona is 85. When combined with the state rate each county holds the following total sales tax. For example imagine you are purchasing a vehicle for 45000 with the state sales tax of 56.

US Sales Tax Rates OK Rates Sales Tax Calculator Sales Tax Table. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The base state sales tax rate in Arizona is 56. Pinal County 72 percent.

Below 100 means cheaper than the US average. The average cumulative sales tax rate in Peoria Arizona is 81. Peoria is located within Maricopa County Arizona.

The Arizona sales tax rate is currently. You can print a 81 sales tax table here. The Peoria sales tax rate is.

Generally taxing districts tax assessments are consolidated under a single notice from the county. Within Peoria there are around 6 zip codes with the most populous zip code being 85345. The average sales tax rate in Arizona is 7695.

Greenlee County 61 percent. Find your Arizona combined state and local tax rate. Sales Tax Office in Peoria AZ.

Groceries are exempt from the Peoria and Arizona state sales taxes. Find information on obtaining a business license or sales tax license in the City of Peoria Arizona. 100 US Average.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. As of 2020 the current county sales tax rates range from 025 to 2. 9578 W Irma Ln Peoria AZ 85382-5145 is a single-family home listed for-sale at 435000.

Sales tax in Peoria Arizona is currently 81. You can use our Arizona Sales Tax Calculator to look up sales tax rates in Arizona by address zip code. You can find more tax rates and allowances for Peoria and Arizona in the 2022 Arizona Tax Tables.

If this rate has been updated locally please contact us and we will. Local tax rates in Arizona range from 0 to 56 making the sales tax range in Arizona 56 to 112. See reviews photos directions phone numbers and more for the best Taxes-Consultants Representatives in Peoria AZ.

Arizona has 90 seperate areas each with their own Sales Tax rates with the lowest Sales Tax rate in Arizona being 585 and the highest Sales Tax rate in Arizona at 10. Arizona sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience.

This is the total of state county and city sales tax rates. This includes liquor licenses pawn shop licenses and other types of business licenses as required by law. How to Calculate Arizona Sales Tax on a Car.

The County sales tax rate is. Maricopa County 63 percent. Every district then is given the assessed amount it levied.

Peoria AZ 85345 Monday - Thursday. This includes the rates on the state county city and special levels. How Peoria Real Estate Tax Works.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Taxes in San Francisco California are 1399 more expensive than Peoria Arizona. Arizona gives real estate taxation rights to thousands of community-based governmental entities.

The December 2020 total local sales tax rate was also 6850. Above 100 means more expensive. Method to calculate Peoria sales tax in 2021.

Interactive Tax Map Unlimited Use. The current total local sales tax rate in Peoria AZ is 8100. How Does Sales Tax in Peoria compare to the rest of Arizona.

Arizona has a 56 statewide sales tax rate but also has 80 local tax jurisdictions including. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. Wayfair Inc affect Arizona.

The 81 sales tax rate in Peoria consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 18 Peoria tax. Phoenix is located within Maricopa County ArizonaWithin Phoenix there are around 70 zip codes with the most populous zip code being 85032As far as sales tax goes the zip code with the highest sales tax is 85001 and the zip code with the. There is no applicable special tax.

The Peoria Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Peoria local sales taxesThe local sales tax consists of a 070 county sales tax and a 180 city sales tax. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. The sales tax rate for Peoria was updated for the 2020 tax year this is the current sales tax rate we are using in the Peoria Arizona Sales Tax Comparison Calculator for 202223.

Cochise County 61 percent. Sales Tax Calculator Sales Tax Table. The average sales tax rate in Colorado is 6078.

How much is sales tax in Peoria in Arizona. Ad Lookup Sales Tax Rates For Free. Effective June 1 2019 Friday.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Peoria AZ. About our Cost of Living Index.

The minimum is 56. For more information on vehicle use tax andor how to use the calculator click on the links below. This includes the rates on the state county city and special levels.

The minimum combined 2022 sales tax rate for Peoria Arizona is. The sales tax rate does not vary based on zip code. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Arizona local counties cities and special taxation.

Apache County 61 percent. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Did South Dakota v.

Method to calculate Peoria sales tax in 2021. Multiply the vehicle price after trade-in andor incentives by the sales tax fee. The official website for the City of Peoria Arizona features city news upcoming events online bill payment issue reporting and more.

How is Sales Tax. Peoria OK is in Ottawa County.

Rate And Code Updates Arizona Department Of Revenue

Transaction Privilege Tax Simplification 2015 Arizona Transaction Privilege Tax Simplified Ppt Download

Arizona Income Tax Calculator Smartasset

Peoria Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Arizona Sales Reverse Sales Tax Calculator Dremployee

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona

Arizona Gasoline And Fuel Taxes For 2022

Arizona Income Tax Calculator Smartasset

Peoria Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

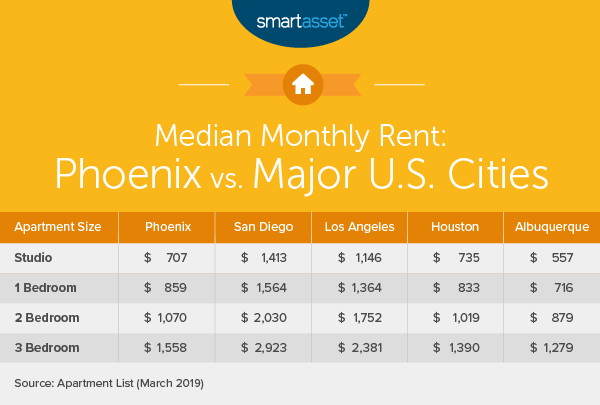

Cost Of Living In Phoenix Smartasset

Is Food Taxable In Arizona Taxjar

Arizona Sales Tax Rates By City County 2022

Peoria Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

2021 Arizona Car Sales Tax Calculator Valley Chevy